Solutions to the Distressed Real Estate Industry in South Africa in 2023

Blog Contents

The state of the Impaired And Distressed Real Estate Industry and why it needs urgent change.

This article follows up on groundup.org.za’s article on misconduct related to Sale in Executions, and the subsequent process of implementing Rule 46

Assist Group’s Directors and its subsidiaries have been involved in the impaired and or distressed real estate market since 1991 (30+ years) and, since 2002, together with attorneys we have developed various uniquely structured solutions within the laws of South Africa.

It is evident from the numerous unscrupulous acts of industry participants that Sales in Execution is not the solution for the industry, and each of them contributed to its current state. One of the interesting aspects of this process is that when viewed from the outside, it is astonishing that no one can see that there is always only one party that has the advantage in this process, however with the right approach and solutions, we can all walk away winners.

As the judge said in this article, “Real Estate Owners need to be properly served” and that process does not begin during a court action, but from the beginning of the pre-legal, legal, and litigation process, or, more importantly, by preventing litigation. Even though litigation can be avoided, there is not enough done to do so in the initial stage. Substantially better solutions can be found to resolve issues without going through litigation.

The Challenges in the impaired and distressed real estate owner industry

Let us be clear, Sale in Execution has never been the best solution to liquidate an asset to recover their debt (mortgage or unsecured debt) while also protecting the proceeds and investment made in the property. In addition, there are better ways to address the challenge real estate owners are facing, which in most cases, can be resolved with the correct advice and guidance at the right time.

Lack of enthusiasm to cooperate: While we at Assist Group work with numerous attorneys daily as well as with the various financial institutions’ pre-legal and legal departments who are cooperative, it, unfortunately, is not the norm. The impaired property industry and its process offer too many opportunities for parties to abuse the system for their own gain. From financial institution employees to unscrupulous parties who seek to purchase the property at ridiculous prices, because the property owner lacks knowledge of the process, or awareness of alternative solutions, and is terrified of the outcome and threats.

Real Estate Owners need to avoid these costly and ineffective practices

- Take time to explore your options to avoid making hasty decisions. In many cases, property owners do not consult impaired property specialists before attempting the most common solutions. Consult the correct council and count the costs before taking any actions. Because of this, it is important to act immediately after identifying a challenge and not wait until later in the process. Prompt action will save you money and give you more time to make sound decisions.

- Avoid getting into a litigation battle with the institution or creditors if a solution can be reached amicably. 90% of the time, real estate owners follow the fight or flight approach which is not the best action in these situations. If you need assistance in assessing your current situation, one of Assist Group’s subsidiaries can assist you to find an amicable solution to the issue without litigation. The laws and regulations related to reckless lending, National Credit Regulations, Consumer Act, SA Property Law, and more can be used to produce proper solutions, as the director and management of the Assist Group have been doing for many years.

Consult with parties who understand the industry, as well as those who can provide legal solutions that are tailored to your challenges as early as possible to avoid litigation. Be careful of attorneys who eagerly want to propose litigation as the only option. We found over the years that the apatite of institutions and creditors dwindle very quickly to work towards amicable solutions after the Real Estate Owner has litigated with them. Do not be “the unwise” who works for the attorney’s litigation fees instead of your solution with the least resistance and cost.

How lack of cooperation keeps the impaired property industry from being repaired

- The biggest challenge we have encountered over the years is that real estate owners fail to keep their commitments and payment arrangements during the default process and believe they have plenty of time to stop their arrears before it becomes unmanageable, instead of consulting impaired specialists like Real Estate Assist, who can help you take the shortest and less expensive path of least resistance to an amicable solution. This includes some of the diverse options offered by the banks, like restructuring payments, mandated sales, another rule 46 actions, and more.

- Institutions, creditors, and attorneys’ unwillingness to implement alternative solutions that will save time money, and cost. While we have met with at least two institutions on a national management level and proposed these solutions to them, none of the institutions have yet agreed to test the model, even though we have numerous case studies and a proven track record of implementing these solutions successfully over the last 8 years. Although institutions and credit providers provide solutions, they are not always successful e.g., Real Estate Owners use mandated sales to stall. Mandate sales result in one outcome, which is the sale of the Real Estate Owners Home or Property, and in most cases, is not the solution the owners prefer. Most Agents, unfortunately, encourage this, which is understandable given that they have few options and solutions available to them. Assist Group has a Real Estate Ambassadors program that lets Estate Agents introduce different solutions to their clients, and still earn income and help the client. The objective advice and guidance we provide are not only driven by on sales, but also by offering other options, and the potential outcome of these options in most cases enables owners to make the correct decisions to create a lasting result.

- Avoid the exuberant legal cost throughout the entire process, from the pre-legal process to the litigation and sale in execution and auction process as well as per the article, the post-auction process.

- Neither the sale in execution nor other auctions will solve the problem. In South Africa, auctions have always been regarded as a place to buy property below market value, and although auction houses have tried to change that stigma for years, it remains. There will always be factors limiting the price reached at auctions, including how, when, and the terms and conditions of SIE and other auctions, as well as the regulations.

The solution to the current impaired and distressed real estate owner industry

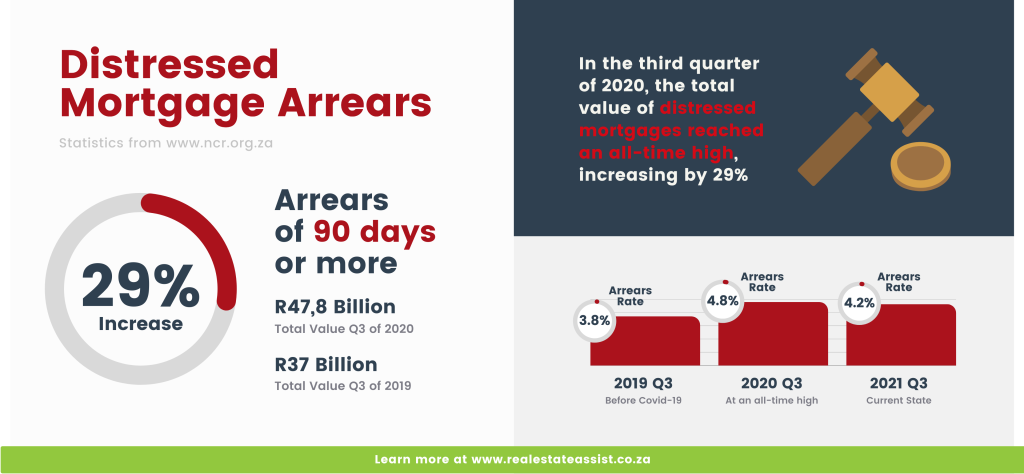

The Assist Group believes that achieving a resolution to the huge challenge that the Impaired and Distressed Owner industry is facing can be achieved through collaboration and cooperation between the various professionals and role players in the industry. Here are some statistics that illustrate the need for better solutions.

What this illustration does not show us is that the grace period for most people who found themselves in distress in 2020-2021 has already expired or is about to expire. As we are already seeing with the number of applications, we receive week after week from distressed homeowners and can anticipate a substantial increase in Sales in Executions.

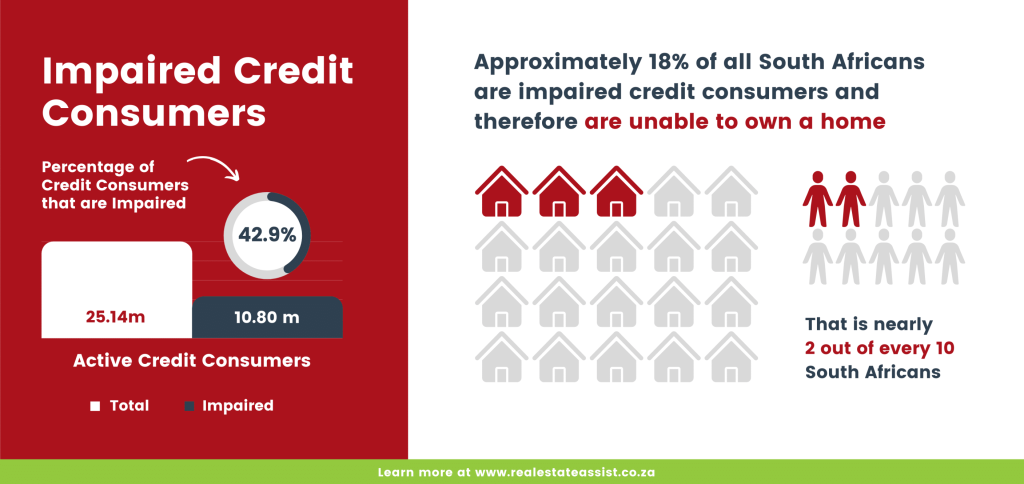

- Through proper collaboration, there are many participants that can establish lasting solutions to the impaired and distressed real estate owner industry, as long as the focus is not to exploit the real estate owners’ situation to enrich themselves. The goal should be to make a real measurable impact on everyone involved in the program and in particular on real estate owners who, in most cases, own only one home their most valuable asset and place of security. Furthermore, to assist those potential homeowners who are impaired credit consumers as per the statistics below, we should assist them to restore their credit status in order to qualify for a mortgage and to own a home.

- For the process of litigation to be avoided, the role players need to put extra emphasis on first understanding the real estate owner’s situation and position as a whole, and if they are unable to do that due to the numbers, they will need to have private organizations, for instance, a panel, to assist with proper research of the available options, including but not limited to those of the bank to resolve the matter in the quickest and least costly way.

While we continue to negotiate with the financial institutions, we will use interim solutions, such as:

- Encouraging real estate owners to contact us as soon as possible in the process, though we can still assist until 2-3 weeks prior to the sale in executions.

- Real estate agencies can contact us if you are interested in assisting real estate owners with alternative solutions, if need to still sell after research, secure a sole mandate to sell the property whilst maximizing the proceeds of the sale and provide peace of mind.

- We encourage Financial Institutions and Creditors to contact us to assist all parties in the process with quick and unique solutions that will result in a win-win for all.

- Attorneys, Bond originators, auditors, debt consolidation, debt review organizations, and others who are willing and able to help and participate, should visit our website www.assistgroup.co.za or contact enquire@assistgroup.co.za to learn more about how they can get involved or just call us on +27 21 2015344.

We invite you to visit our website at www.realestateassist.co.za if you are a homeowner

Visit www.wealthassist.co.za if you are or want to be an Impact Real Estate Investor