Short Sales vs Foreclosures in South Africa : What’s the Difference?

If you’re in the market for a new home, you’ve probably come across properties listed as “short sales” or “foreclosures.” But what exactly does that mean? And more importantly, what’s the difference between the two? Keep reading to find out.

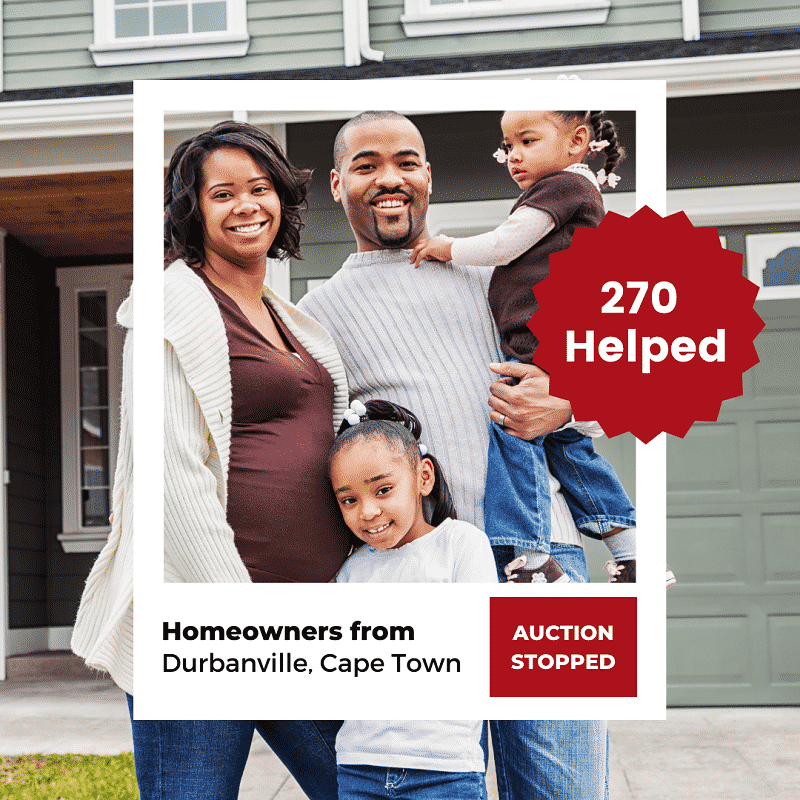

Stop foreclosure and Short sale and recover!

Property Short Sale Definition

Short sales are when someone offers to sell their property for less than they owe on their mortgage.

A short sale is usually done because the person needs to sell their property quickly, and they don’t want the lender to take it away in a foreclosure.

The money from a short sale goes to the lender. The lender can choose to forgive the remaining balance, or they can try to get the former homeowner to pay them back all or part of the difference. Some states have laws that say if there is a difference in price, then the lender must forgive it.

Short sale Example

A short sale is when a homeowner sells their property for less than the amount they owe on their mortgage. For example, let’s say you owe R2 000 000 on your mortgage but can only sell your home for R1 800 000. In this case, you would be “short” R200,000. Short sales are typically used as an alternative to foreclosure because they don’t have as negative an effect on your credit score.

Foreclosure definition:

Foreclosure, on the other hand, is when a lender repossesses your home because you have defaulted on your loan payments.

This process can take months—or even years—to play out, and during that time, the home is usually left vacant. As you can imagine, this often leads to the property falling into disrepair, which can significantly lower its value. Not to mention, a foreclosure will stay on your credit report for up to seven years, making it very difficult to qualify for new loans during that time.

short sale or a foreclosure?

So, which should you choose—a short sale or a foreclosure? Ultimately, that decision will come down to what makes the most financial sense for your situation ( We don’t recommend either of the above mentioned) and can help you with alternative property solutions. However, if you’re looking to buy a home in the near future and are worried about how a foreclosure might affect your credit score, a short sale may be the better option for you.

Contact us for your best property solution, we have better alternatives than both above mentioned where you as a homeowner can actually get back on your feet and get something out of the sale and settle your debts.